Streamlining Business Financial Operations 3533402293

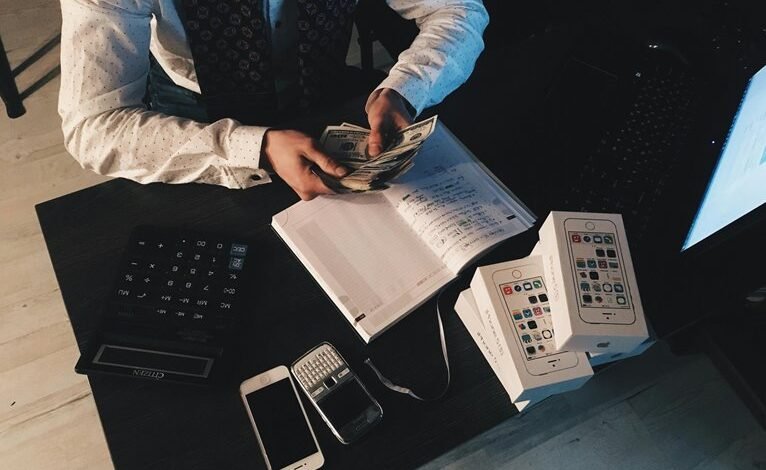

Streamlining business financial operations requires a systematic evaluation of existing processes. Identifying inefficiencies is crucial for improving transparency and accountability. Automation plays a significant role in reducing errors and accelerating payment cycles. Integrating advanced financial management tools can further enhance workflows. However, the success of these initiatives often hinges on the capabilities of the financial teams involved. This raises important questions about training and adaptation in a rapidly evolving financial landscape.

Assessing Current Financial Processes

How effectively are businesses managing their financial operations? A thorough financial audit reveals inefficiencies in current practices.

By employing process mapping, organizations can visualize workflows, identify bottlenecks, and streamline tasks. This analytical approach not only enhances operational transparency but also fosters a culture of accountability.

Ultimately, businesses that assess their financial processes stand to gain significant freedom and flexibility in decision-making.

Implementing Automated Solutions

Following the assessment of current financial processes, businesses are now positioned to enhance their operational efficiency through the implementation of automated solutions.

Automated invoicing reduces manual errors and expedites payment cycles, while efficient expense tracking streamlines budget management.

Enhancing Data Accuracy and Reporting

As organizations increasingly rely on data-driven decision-making, enhancing data accuracy and reporting becomes essential for financial operations.

Implementing robust data validation techniques ensures that information adheres to established reporting standards, reducing errors and improving reliability.

Accurate data not only fosters transparency but also empowers stakeholders to make informed choices, ultimately driving efficiency and reinforcing financial integrity within the organization.

Integrating Financial Management Tools

Building on the foundation of accurate data and reporting, the integration of financial management tools plays a pivotal role in optimizing business financial operations.

Effective financial software and budgeting tools enhance decision-making by providing real-time insights and streamlined processes. This integration enables businesses to allocate resources strategically, minimize errors, and ultimately achieve greater financial agility, fostering an environment of independence and informed decision-making.

Training and Developing Financial Teams

Effective training and development of financial teams are essential for maximizing the potential of integrated financial management tools.

By fostering team collaboration, organizations can enhance communication and streamline workflows.

Skills enhancement initiatives equip team members with vital financial competencies, enabling them to utilize tools efficiently.

This strategic focus on training not only improves performance but also empowers teams to adapt in a dynamic business landscape.

Conclusion

In a world where spreadsheets reign supreme and manual entry is an Olympic sport, streamlining financial operations emerges as the unlikely hero. By embracing automation, businesses can finally retire their beloved error-ridden spreadsheets and transform chaos into clarity. As teams undergo training to wield these new tools, one can only hope they don’t mistake them for the latest office coffee machine. Ultimately, this evolution promises not just agility, but a financial renaissance that might even make accountants smile—if only for a moment.